Self-build insurance: what is it and why do you need it? Our self-build expert advises

Self-build insurance ensures you, your contractors and your home are all protected in case the worst happens during your build. Here's what you need to know

- Why do you need self-build insurance?

- What is a self-build insurance policy?

- Do builders have insurance?

- Sub-contractors and insurance

- When should self-build insurance begin?

- Self-build insurance for extensions, renovations and conversions

- Self-build insurance costs

- Where to buy self-build insurance

- FAQs

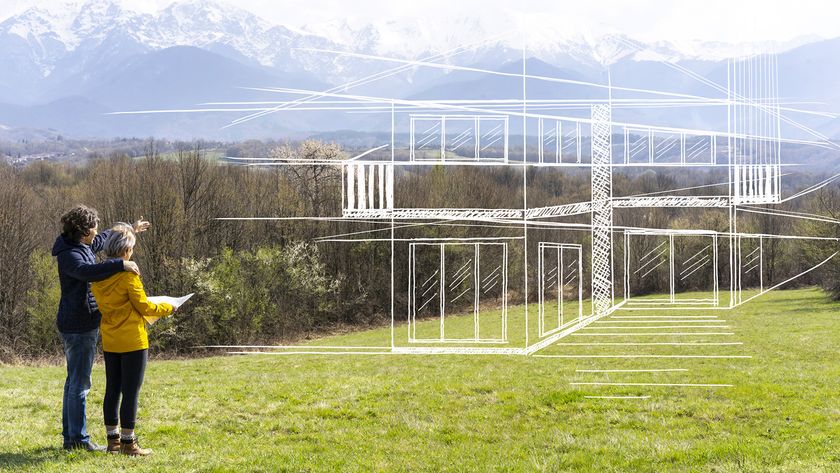

You’d be surprised how many people don’t have adequate self-build insurance, especially given the fact that a new home is quite likely to be the single biggest investment in a self-builder’s life.

To risk it without proper insurance could leave you in a desperate financial situation, especially if you consider that just one mishap could leave your project in dire circumstances.

You might think that if your builder has insurance then you are covered for all eventualities, but in practice this is not the case. Right from the moment you buy your plot or before work begins on a self-build, extension, conversion or renovation you should have the paperwork in place for specialist site insurance, tailor made to your specific project. This type of policy not only covers new work but the existing structure and the rest of the site and is something that would not be covered through your current buildings insurance.

This guide explains everything you need to know about self-build insurance, from why and when you need it and what your policy should cover.

If you already know you need self-build insurance, get a quote today from our partner Self Build Zone to protect your self-build project.

Why do you need self-build insurance?

We are used to insuring our most valuable possessions these days. Yet every year lots of people build a house or renovate their own homes without any insurance – a project costing tens and even hundreds of thousands of pounds. For many of them, the gamble pays off – if indeed they even knew they could insure their project in the first place. But it can be an extremely false economy.

Building sites are risky places – not just for accidents but also for things like theft – and anyone taking a project like this seriously needs to account for the bad things that might happen, as well as the fantastic and exciting things that will.

Beyond an insurance policy providing peace of mind that is worth its weight in gold, lenders and especially those consistently working to help self-builders, are increasingly demanding proof of the existence of a suitable policy before releasing funds.

It is ultimately the responsibility of the owner of the site, whether that’s an empty plot, or an occupied or unoccupied property, to ensure that the correct policy is in place during any construction work.

If you specifically appoint someone else to be in charge of health and safety on site you should agree to this in writing with a formal contract or even an email exchange. Builders will often only have public liability insurance, but this doesn’t cover the site while they are not there or for anything they are not responsible for.

All tradespeople working on site should have their own insurance in place and other professionals, such as structural engineers, should have professional indemnity insurance, but neither of these are legal requirements.

What is a self-build insurance policy?

A self-build insurance policy is a specialist insurance products that covers you, your builders and your building site during the construction process, as well as your new home, at whatever stage of the self-build schedule it's at.

“What you need to look for is a self-build insurance policy that covers your particular site, not a site policy designed to cover a contractor for multiple projects in a period of time,” says Jake Fitness, team leader at Self Build Zone. “This type of specialist insurance includes one policy per project and covers everything from changing a light switch to laying foundations and up to 10 years after the structure is built.”

Site insurance should cover the existing structure, if there is one, and everyone being employed on site – even if they have their own insurance – as well as any other individuals who may come on site, such as delivery drivers, for example.

A good self-build insurance policy will include, but not be limited to:

- Contractors All Risk: This element of the insurance policy provides cover for general mishaps such as fire, theft, vandalism, flood and storm damage

- Employers’ Liability: Anybody working on your site is deemed to be an ‘employee’ for insurance purposes and, as such, as the main contractor you are liable for their welfare and for any injury, loss or death while they are working for you

- Public Liability: Damage, injury or loss that is suffered by third parties or members of the public is covered by this section. Those who own land which they intend to eventually develop would be well-advised to have a policy limited to public liability in place. Most of the self-build insurance specialists will be able to arrange this, with it converting to a full site insurance policy upon commencement of work. The public liability section of a self-build site insurance policy would also cover for damage to the property or injury to persons outside the site, if directly caused by the activities of the site

- Legal Expenses Insurance: Any legal expenses within the policy will normally be included by the dedicated self-build insurance providers but, in other cases, can be bolted on as additional cover for action taken against the self-builder by others or for the need to take action against third parties

- Contract Works: This covers the potential cost of repairing or replacing any part of the build that is damaged.

It’s also worth noting that not all insurance policies are equal. Some also offer easy-to-use contract templates, which can be useful, while others charge extra for personal injury cover and legal expenses, so check what’s included at the very start.

Optional levels of cover may include things such as plant hire, which you only need if you hire or buy anything in your name. If a tradesperson hires something it’s their responsibility to insure it.

Do builders have insurance?

There’s no guarantee that your builder/main contractor will have insurance — you’d be surprised at just how many builders and tradespeople don’t carry any/or adequate insurance for the work they do, especially if they work ‘cash-in-hand’.

Those carrying out a project by using a builder with a single contract may feel that, as the builder has their own insurance policy, there is no need to go to the expense of a policy in their own name. They might be right, but as part of the process of finding a builder you should check the details of the builder’s policy to firstly make sure that it’s current and secondly, that it is sufficient to cover for any eventuality.

“Before any work begins, ask for a copy of their insurance to see what they are covered for and more importantly look for what is excluded,” says Jake Fitness. “While some larger developers will have contract work insurance, smaller building companies will probably not have this in place, often just going for the cheapest public liability policy.”

Even if the builder’s policy is technically sufficient, the whole business of self-building is to get what you want and to be interested and involved in the process, and the chances are that at some point you will opt to buy your own materials such as kitchen units, sanitaryware or even plumbing equipment.

But if any of those items get stolen or damaged, because the builder didn’t buy them and never had title to them, they will not be able to claim for them. So it really does make sense to have your own self-build insurance policy.

Sub-contractors and insurance

If you are building using subcontractors or direct labour, then technically you are seen to be the main contractor and you are deemed to be employing all of the people working on the site. Even if the subcontractors do carry professional insurance, the chances are that if they have an accident, they will see your insurance as the best option for recompense and if you haven’t got it, then you’ll be in trouble.

When should my self-build insurance begin?

This depends on your project and if you are unsure, check with your current provider or a specialist company. If you have been trying to find a plot and are in the process of buying it, remember that an empty plot of land only requires public liability insurance until construction work begins, for example. If there is an existing unoccupied building on site, then you need unoccupied buildings cover. Bear in mind that people will be visiting the site to access it and make plans before any actual work begins.

“Site insurance should be taken out as soon as contracts have been exchanged or right before work is about to start on your self-build site and whether you are converting, extending, renovating or building from scratch, it doesn’t really differ, except for original structure cover,” advises Jake Fitness from Self Build Zone. “Some companies offer a renovation policy, but you should double check whether it is just for renovation and doesn’t include the changing of structural walls.

“Small projects, such as replacing glazing, remodelling a kitchen or renovating bathroom come under modernising and should be covered under your buildings insurance, but more extensive building work should move from a standard to a specialist insurance policy,” continues Jake. “Both insurances can run at the same time, but typically most building insurance companies will withdraw their cover, although you should continue with a contents insurance policy for an existing property.”

The best advice when researching insurance is to do your own research and don’t assume anything. Remember, site insurance is not like normal house insurance and it won’t automatically renew and you probably won’t be sent a reminder when the policy is about to end. Policies vary in length from three to 24 months and you can extend them if needed, although it’s more cost effective to have a longer one from the start, bearing in mind that most build projects over run.

Self-build insurance for extensions, renovations and conversions

Most people don’t realise altering the structure of their home is an exclusion of their home insurance policy. Most home insurance policies include exclusions for works over £25,000 or altering the structure of your home.

Therefore if you are building an extension, renovating a house or doing a conversion you could be in breach of your policy and end up without a valid home insurance policy. When you are preparing to start work you’ll need to notify the home insurance provider, if they don’t cover the works you’ll require site insurance to cover your existing home and the new works being carried out.

Self-build insurance costs

When working out how much it costs to build a house, you should account for self-build insurance costs in your budget.

Most self-build insurance policies work on the basis of a single premium. For new builds this is based on the rebuilding costs on a sliding scale, and for a home of around 140m² the average cost will be between £600 and £1,200, with the variation accounted for by the proposed construction costs.

It’s also important to work out the figures correctly. Site insurance covers for the demolition and reinstatement costs so all figures, such as rebuild costs, should be accurate. Even if you are not starting the work straight away, start your enquiries early.

Your site insurance will be a bespoke policy so the cost will be calculated for your exact project. Risk factors, such as whether your type of roof is flat or thatched, the materials being used and whether the property is in a flood area are all elements which will need to be taken into consideration and will affect the final quote.

Where can I buy self-build insurance?

Once you have clarified with your existing buildings insurance on what you are covered for you should contact a specialist insurance company to discuss your requirements. It's easy to get a quote either over the phone or online.

Do be careful about going to your usual high street broker, as they’ll probably think that you need the same sort of policy as a builder or developer – and that’s not the case. There are dedicated self-build insurance providers, with the premium costs being very much less than the standard prices which builders have to pay each year.

Homebuilding & Renovating has partnered with leading insurance specialist Self Build Zone to provide bespoke solutions at market-leading rates for its readers. Get a quote now to protect your self build.

FAQs

What happens to the self-build insurance policy at the end of my self-build?

When a self-build insurance policy ends at the completion of the build, many providers offer the choice to turn it into a standard homeowner's insurance policy at this point. Either way, your self-build insurance only covers the construction phase, so you'll need to take out a standard policy after it concludes.

It's also a good idea to take out a self-build warranty for when your build is complete. This covers your home if any structural issues occur in the years following the completion of the build.

Although a structural warranty is not a legal requirement it is usually a mortgage requirement for all new build projects, so if you have a mortgage or expect to remortgage or sell the property within 10 years after completion, the lender will only usually lend if you have one in place.

“If you are planning to sell the property to someone who requires a mortgage they will probably require one so you may want to put this in place from the start,” says Jake Fitness. “Plus some local authorities will ask for evidence of a self build warranty as self-builds are exempt from the Community Infrastructure Levy.”

If you are going down this route you should arrange this before you begin work as the cost will increase further down the line, or once a project has been completed. Before arranging your warranty, you need to check that your provider is accepted by your lender.

What other insurance do I need for a self-build?

Personal possessions and furniture will not be covered by a self-build insurance policy, although where a self-build policy is converted to a household policy upon completion of the project, cover will then be extended in the normal way.

The prudent self-builder will want to ensure that in the event of their death, or incapacity, the project can be finished. They will, therefore, arrange additional life and/or injury cover for themselves and/or their beneficiaries.

Your self-build, renovation or extension is likely to be one of the largest investments you make in your life, so purchasing self-build insurance is always going to be a worthwhile investment. Whether you, your builder or your architect are going to be the project manager, it's ultimately in your best interests to ensure you have adequate cover in place.

Get the Homebuilding & Renovating Newsletter

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

David is one of the UK's leading self build and plotfinding experts, and a serial self builder who has been building homes for 50 years. The author of Building Your Own Home, now in its 18th edition, and the Homes Plans Book, David spent decades as a speaker and expert at self build exhibitions such as the Homebuilding & Renovating Show. He also helped countless budding self builders find their dream building plots as part of his long-running Plotfinder Challenge series in Homebuilding & Renovating magazine. He has self built 14 homes.

- Beth MurtonEditor of Homebuilding & Renovating