How much is my house worth? How to calculate the value of your home

Knowing 'how much is my house worth?' is crucial to any homeowner. Here's our guide on calculating your home's value

'How much is my house worth?' is a question most homeowners ask after completing any kind of home improvement work.

And it isn't just those working on self build projects who want to know. Those who snapped up a bargain before house prices shot up might be wondering what kind of money they've made, as well as those who want to check the bubble hasn't burst after plunging their life savings into a 500sq/ft flat in South East London.

Whatever your reason for wanting to know the value of your house, here's our in-depth guide to calculating how much your house is worth, right now.

How do you calculate the value of a house?

To get a realistic idea of what your property is worth, you need to look at several different sources of house price data.

After you get an idea of this, you need to consider other factors (explained below) that could alter this figure to narrow down your house price range and decide on a fair value.

Essentially all this information should work together so you get a good idea about how much your house is worth.

1. Ask an estate agent in your local area

Nobody knows house prices in your area better than the local estate agents and this is the typical go-to way to learn the value of your property.

That said, estate agents might have an agenda – be it, trying to convince you to market your home, or trying to sell your home quickly to pocket the commission. With this in mind they could value your house higher or lower depending on the scenario. Therefore, it's always recommended to get at least three different local estate agents to value your property.

However, some local estate agents can be stuck in the past with their valuations, swayed by a perceived or historic "ceiling price of the estate" or area that new buyers, often from London, are no longer worried about.

One recent example of this was a family selling their home in a town outside of London, who had to remarket the property when the sale looked uncertain (which did later successfully complete).

The family, who wanted to remain anonymous, told Homebuilding & Renovating that the property had two successful surveys carried out at the agreed sale price but when a local estate agent was approached, they wouldn't budge from a valuation £15,000 below the agreed sale price. It later transpired that this was also £40,000 below the value the mortgage lender had given the property.

Still, estate agents can give you a good initial starting point.

2. Check out historic house values on your street

While house prices across the country have risen sharply in the last couple of years, looking at historic house prices can offer up an idea of the comparative value of your home to others in your area.

You can do this on the Land Registry on their "price paid dataset". This will give you information such as sold price, the sale dates for each address, the type of property (detached, semi etc), whether it was freehold or leasehold, and whether the property was a new build. You can also click on the sale price data to find out the transaction category, for example a repossession.

This "price paid dataset" is where other sites such as Zoopla and Rightmove pull their historical sold price data from. That said, these websites sometimes offer up the added bonus of the sales particulars from a property sale so you can have a snoop inside the house to see what state it was in when it made that value.

In terms of processing what this data means, if you know your neighbour's identical home was sold in immaculate condition a year ago for £250,000, then you can compare this information with UK house price index (HPI) data, explained in more detail below, to get an idea of what it (and your home) would be worth now.

This is also handy to know so you get an idea about what you can do to improve the value of your home or what isn't worth doing. For instance, if a home with an extension on your street is worth significantly more, then it might be worth considering adding an extension to your own property. However, if there isn't much added value, then you'll know not to bother unless you need the extra space yourself.

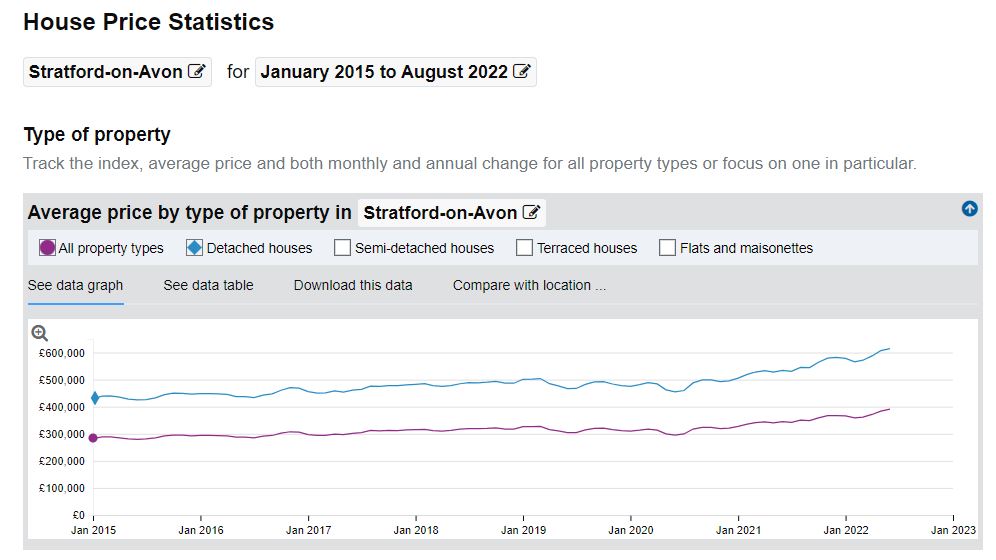

3. Cross-reference sold prices with HPI data

The Land Registry also has a decent HPI tool where you can see how house prices have changed in your area. This takes into account all house sales, cash and mortgage across the UK with a few exceptions.

The landing page also gives you an overview of house prices in the UK before clicking through to use the tool.

Using the tool, you can change the parameters to make them specific to your area as well as increasing the timeframe by clicking on the square edit icon.

The results graphs will show you changes in average price, a yearly or monthly percentage change, as well as the HPI data by property type, buyer type and more. You can also toggle between all sales, detached houses, semi-detached houses, terraced and flats to find the most relevant data for your home.

With a bit of GCSE maths, you can cross-reference this data with your historic house price data (i.e. how much you paid for your home at a given date) to work out an approximate value for your home.

This method comes with the caveat that any improvements you've made to your home won't be included in this approximation. It is purely about inflation/deflation of the housing market.

Working out the value with HPI data:

The best way to do this is to scroll down to the UK HPI data for your area, timeframe type of home you have (detached etc), then use the most recent UK HPI figure (i.e. for June 2022) along with the UK HPI figure when you purchased your house.

Calculate the percentage increase on the two UK HPI figures (here's how to do it if you aren't sure) and then apply this percentage increase to the price you paid for your home.

For example, if there was a 22% increase on your original purchase price of £200,000, this would be a value of £244,000 today (1.22 x 200,000).

There are other sources of UK HPI data from Nationwide and Halifax (based on their mortgage data) but this data is released on a monthly basis and you can't change the parameters. Government monthly HPI reports are also available.

If you are terrible at maths, there is this handy shortcut: Nationwide has a house price calculator to work out your house value simply by filling in the boxes. When using this, bear in mind it is only based on their HPI data set, which is much broader than calculating it yourself with the Land Registry data. When I did both for the value of my own home, I found a difference of nearly £25,000.

3. Look at the house value when you re-mortgage

Some mortgage lenders are transparent about what the current estimated value of your home might be.

If this is the case, this can usually be seen while re-mortgaging. Nationwide do this and I believe, HSBC do too.

Sometimes, information about what your surveyor valued the house at can also be seen, ideal if you've had the house re-surveyed since buying it (for extra borrowing perhaps or re-mortgaging with a new lender). This is not always the case however as some mortgage lenders like to keep this information under wraps.

4. Browse real time house prices online

Regularly keeping abreast of the property market in your local area is essential to gaining an understanding about your home's value.

Looking in estate agent windows when you nip into town, checking out your postcode on Rightmove, Zoopla, onthemarket and other sites/apps will keep you up-to-date. It's worth ticking the box to include "Sold STC" properties as this'll give a more accurate idea about what people are prepared to pay rather than the price people hope to sell at.

If you look enough, you'll see which properties sell quickly to see how your home might compare.

5. Evaluate the key factors affecting house value

According to Nationwide there are five key factors affecting how much your house is worth. These are:

- UK Location

- Type of neighbourhood, eg council areas, retirement areas, inner city or rural

- Whether your home is detached house, semi-detached, terraced, a bungalow or flat

- The number of bedrooms

- Whether the property is new

It perhaps goes without saying that houses in more desirable locations will be worth more than those in undesirable locations. But what isn't often considered is that what is desirable changes with time and other social factors. The pandemic was a great example of this. London homes suffered a dip in value during lockdown while rural home values soared. Previously the opposite was true.

The value for the type of neighbourhood might change too. Council areas are historically lower value homes, but over time, as people's requirements change, they can become more appealing. Now, council homes can be desirable as they have huge gardens, plenty of space and can be in excellent locations in a city.

Detached homes with more bedrooms have always been worth more too, but again this could dip with social factors, especially as energy prices rise and people look to save money on their heating bills.

Added bonuses like driveways and garages are worth thinking about too.

In some cases, a driveway is a real value-adder while for other properties a driveway might not be as essential. I owned a terraced property with a small front garden in a row where every other house had concrete driveway instead. But because there was free parking on the street and the garden was really pretty with lavender and hydrangeas, it gave it added kerb appeal. The lack of driveway didn't affect the house value because the option to install one was always there if the free street parking ever changed.

6. Look at the condition of your property

This follows on from the key factor of "whether your property is new". Properties where a new homeowner doesn't need to do any redecorating will fetch a higher price compared to a property that needs a complete overhaul.

New build properties are more expensive to buy for this exact reason. There are plenty of families that just don't want the hassle or haven't the time to carry out work to a property.

You can check out our guide on how to add value to your home for ways to boost your home's value if you think your property could benefit.

7. Nearby schools and hospitals can boost value

Another consideration is proximity to schools and health care.

This is not considered a key factor as not all homeowners have school-age children. Likewise, not all homeowners have a need to be close to health care. But for others these factors might be essential and something they are willing to pay more for.

8. Find out if your home is in a flood zone

Friends and family often ridicule me for raising this question, but it can impact house value.

A house that has suffered flood damage in the past might be expensive to insure, or worse, not be covered for flooding. This could potentially leave the homeowner seriously out of pocket if their home flooded, or stuck living in squalor if they can't afford the repairs.

For this reason, always check the Environment Agency's flood map to see if there's any long term risk and factor that into working out how much your house is worth. You can also check flood risk for your specific property by postcode.

That said, surface water flooding is fairly common throughout the UK and the quantity of water is on a different level to a river or reservoir bursting its banks. Many buyers are happy to ignore this, especially given that many homes in supposedly high risk areas have never suffered flooding and never will. In these cases this may not affect house value at all.

9. Consider the season against the overall house value

House prices fluctuate regularly depending on the time of year. Generally, in the spring and summer house value tends to be higher, with house prices peaking in July by as much as 1% more than prices for the rest of the year.

Likewise, in winter and autumn months house values might be lower due to the season rather than an overall trend.

Seasons are therefore important to bear in mind when using real-time house prices to assess how much your home is worth.

Seasonal adjustments are automatically made to UK HPI data.

Get the Homebuilding & Renovating Newsletter

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

Amy spent over a decade in London editing and writing for The Daily Telegraph, MailOnline, and Metro.co.uk before moving to East Anglia where she began renovating a period property in rural Suffolk. During this time she also did some TV work at ITV Anglia and CBS as well as freelancing for Yahoo, AOL, ESPN and The Mirror. When the pandemic hit she switched to full-time building work on her renovation and spent nearly two years focusing solely on that. She's taken a hands-on DIY approach to the project, knocking down walls, restoring oak beams and laying slabs with the help of family members to save costs. She has largely focused on using natural materials, such as limestone, oak and sisal carpet, to put character back into the property that was largely removed during the eighties. The project has extended into the garden too, with the cottage's exterior completely re-landscaped with a digger and a new driveway added. She has dealt with de-listing a property as well as handling land disputes and conveyancing administration.