Buying a house: The process explained step-by-step

Considering homebuying? Our step-by-step guide contains all you need to know from getting finances in place to completing the purchase so you understand your role and that of the professionals involved throughout

Buying a house is a complicated process and one that typically takes several months. However, the experience of going from the first viewing to ownership is likely to be an easier one if you understand what you need to do and when and what else has to happen before the keys are yours.

As well as this, it’s vital to be aware of the role of other people in the process. Homebuying involves you with a range of different professionals and you should understand who they are, when you’ll need them, and the extent of their roles.

Planning ahead is the key to making the steps of finding, financing and purchasing a home as smooth as possible and this expert advice will give you the details you need if you’re buying in England or Wales; meanwhile, buying in Scotland is a different process.

1. Consider your finances

Before you begin to search for a home, you’ll need to think about how to finance your purchase. For many people, housebuying requires a mortgage.

Buying with a mortgage

It’s best to have saved as large a deposit as you can if you’re planning to buy a home with a mortgage. Typically, you’ll need to have at least 5 per cent of the purchase price available but better interest rates are available with bigger deposits. Previously mortgages with a 5 per cent deposit on a new-build home were likely to be refused but they are becoming more available (and see help with buying, below).

If you’ve saved into a lifetime ISA and are eligible, you can get a 25 per cent bonus from the government on what you’ve saved for the deposit.

Borrowing from family and friends

Subscribe to Plotfinder.net to access over 15,000 building plots and properties that could become your next project

If family members or friends are willing to contribute to your house purchase, there are different options available.

"Some lenders offer mortgage products where family or friends can support the buyer with either a cash lump sum for a deposit or as a guarantor who promises to cover the mortgage payments, should the named borrower be unable to do so," explains Charlotte Grimshaw, head of mortgages at Suffolk Building Society. These are often known as 'family assisted' mortgages.

"A new type of product is a joint borrower sole proprietor mortgage which incorporates the additional income of other members of immediate family to boost the amount the buyer can borrow," she continues.

Be mindful about what a mortgage like this involves. "Each lender will have different rules about how money can be lent between family and friends, so it’s important to understand what this means in terms of future financial commitment for all parties," says Charlotte.

"For example, who is named on the property deeds and how much of the property does each party own? Who’s named just on the mortgage, but won’t own any part of the property? Who is liable for the maintenance and insurance? What if one party wants to sell the property? Who is liable for future taxes? Some of these questions will be determined by the lender’s criteria and, in some cases, it can be helpful to seek legal advice to check that any agreement with family and friends is completely watertight."

Cash buying

If you’re in the position to buy a home without a mortgage and have the money available when you make an offer, you are a cash buyer. For a prospective seller this makes you an attractive buyer as you won’t be waiting for a mortgage offer or the sale of another home.

Anti-money laundering laws mean you should be ready for an estate agent to check that your funds are not the proceeds of crime.

Bridging loan

A bridging loan can assist with buying a house, but be mindful that it is not for the long term.

"Bridging finance is a short-term funding solution where a traditional mortgage doesn't work," says Mark Harris, chief executive of mortgage broker SPF Private Clients. "For example, if you are buying a house regarded as uninhabitable because it doesn't have a working kitchen or bathroom, so a mainstream lender won’t agree to a traditional mortgage. A bridging loan will enable you to purchase the property and get the work done before either selling it, renting it out or refinancing onto a traditional mortgage."

A bridging loan can be necessary if you’re buying a home at auction. "Buying property at auction can be tricky if you are relying on mortgage finance because of the tight deadlines," explains Mark. "If your bid is successful, you are committed to the purchase and have only 28 days to complete. This is usually nowhere near enough time to arrange finance unless you opt for a bridging loan, which many people use for buying at auction. Even then you will need to go through a specialist broker who can access bridging lenders, many of which don’t deal directly with the public."

Mark is chief executive of SPF Private Clients, an award-winning financial services intermediary, and was part of the launch team of the company as Savills Private Finance in May 1997. Originally launching as the financial services arm of Savills, SPF has rapidly grown into one of the market leaders in UK financial services. SPF became part of the Howden Group of companies in 2022.

Help with buying

There are affordable home ownership schemes to help with housebuying and these vary by UK country. The first homes scheme in England is for first-time buyers and may allow you to buy a home for less than its market value.

If you are considering building a home or getting someone to build it for you, a help to buy equity loan may help cover part of the cost. You can find details about how to get the loan depending on whether you want to build in England, Scotland or Wales.

First-time buyers in Wales can apply for a loan to help to buy a new-build property under the help to buy – Wales scheme.

Deposit Unlock is a scheme from UK homebuilders for both first-time buyers and movers under which participating lenders get protection on their mortgages so that they can offer you 95 per cent of the price while you put down a 5 per cent deposit.

2. Find a lender

If you need a mortgage to buy a house, you need to find a lender. You can apply to a bank or building society directly for a mortgage but using a qualified mortgage broker has advantages.

"A whole-of-market mortgage broker has access to all the mortgages on the market, as well as some exclusives which you may not be able to get hold of without going through a broker," says Mark Harris. "They will recommend the best mortgage for your circumstances, after getting to grips with your risk profile, intentions and plans for the future."

A broker can let you know what your monthly repayments might be but bear in mind that as well as the monthly mortgage repayment to the lender there are other costs when buying. These include:

- Conveyancing fees

- Surveying fees

- Taxes (depending on the cost of the home): this is known as stamp duty land tax (SDLT) in England and Northern Ireland, land transaction tax (LTT) in Wales, and land and buildings transaction tax (LBTT) in Scotland

- Mortgage fees

- Search fees

- Land registration fees

3. Get a mortgage in principle

It isn’t possible to apply for a mortgage before you’ve made an offer on a home and it has been accepted. However, it is advisable to get a mortgage agreement in principle from a lender before you start viewing properties.

"A mortgage in principle is sometimes also known as a decision in principle, a DIP or an agreement in principle," says Charlotte Grimshaw. "It allows the buyer to know whether a lender would likely be able to offer them a mortgage. It is useful when dealing with vendors and estate agents as it shows the buyer is serious and can afford to buy the property.

"Before providing a mortgage in principle, a lender will ask the buyer for some basic information such as their name, address and date of birth," she explains. "They will also ask for basic financial details, such as their income, outgoings and any existing credit agreements such as credit cards or car finance plans. It’s important to be completely honest when answering a lender’s questions. If not, they are likely to be able to lend less when you come to proceed with an application.

"A mortgage in principle is by no means an iron-clad guarantee," Charlotte adds. "When a buyer has had an offer accepted on a property, they then need to make a full mortgage application. This is when the lender does a deep dive into the applicant’s financial situation and the property (mortgage security)."

4. Find a property

There are a variety of ways to find properties for sale and you should make as wide a search as possible.

Estate agents

While you may spend a lot of time looking for a home online, it is still worth making direct contact with estate agents in the area where you want to buy, and registering with them. It won’t cost anything and it may give you the chance of hearing about a property from them before it goes live online.

Online

There are many property portals on which to search, including Rightmove, Zoopla, Onthemarket, and Prime Location plus many more. Estate agents also have individual sites.

If you want a home to refurbish or renovate, or a plot on which to build a home, Homebuilding & Renovating's sister site Plotfinder allows you to search by area and is highly recommended when looking for either building plots or renovation and extension opportunities.

Interested in buying at auction? As well as traditional auctions (see below) in what is known as the modern method of auction sites such as Bamboo Auctions, GOTO Properties and iamsold hold online auctions. Buying this way means you don’t need to exchange on the day if yours is the winning bid, but you do have to pay a reservation fee and you forfeit this if you change your mind or aren’t able to complete the purchase in time.

Auction

A property auction provides another way to buy a house at an event at which the auctioneer invites bids on a property.

If yours is the winning bid you need to pay a deposit and exchange contracts right away and you then have 28 days to complete your purchase. Fail to do so and you’ll lose the deposit and possibly incur additional costs.

You can find properties to be auctioned on online property portals or find auctions via sites like Essential Information Group.

Approaching owners

If you like a particular street or small area, it could be worth putting leaflets through the doors of those living there to see if it might prompt them to sell.

Telling people a little about yourself as well as providing contact details could help as those who might not sell to a property developer might be sympathetic to first-time buyers or families, for example.

More personal, but potentially a more uncomfortable experience, is going round to homes in a street and explaining to those who answer your knock that you would like to buy there. Take contact details to leave with the owner in case they are tempted after thinking about it.

5. Put in an offer

It’s vital to view homes in person rather than simply looking online. Be aware that estate agents may want to know about your financial position before they show you a home, however.

"Buyers should not have to endure the third degree from estate agents before viewing property," says Jeremy Leaf, north London estate agent and a former RICS residential chairman. "However, buyers ought to be prepared to offer at least some details of how their proposed purchase will be financed."

The reason? "There’s nothing worse for a seller than accepting an offer from someone who has not provided sufficiently robust financial information in advance and is then unable to proceed," he explains. "An offer may have been rejected from another party at a similar or slightly lower level who could have been in a better position to proceed."

If you want to put in an offer, deciding how much this should be isn’t easy. Land Registry information can reveal sold prices of nearby homes and there are online valuation tools you can use. Consider factors such as whether the local market is moving fast and how long the particular property has been on the market, too.

If you want to offer, phone the estate agent to make an offer verbally and confirm it in writing (email is sufficient). Stipulate that the offer is subject to survey and the property’s being taken off the market. Include any details that make your offer more favourable like being a cash buyer or not in a chain. You may have to negotiate after your offer so be ready for this.

On some properties you may be asked to make a sealed bid. "In a competitive tender, buyers should be aware further re-negotiation may not be possible once their offer is submitted," says Jeremy Leaf. "In those circumstances, a bid should be submitted putting their 'best foot forward', including anticipated timing for exchange of contacts and completion as well as, of course, background to financial arrangements (if any) to fund the proposed purchase.

"Buyers should not kick themselves afterwards if possible, ie they would have been prepared to pay a higher sum, if they find out a property has been sold for only slightly above their offer," he cautions.

Buying at a traditional auction requires a bid rather than an offer. If yours is the winning bid you need to be ready to exchange contracts and pay the deposit. It is sometimes possible to make an offer on a property before an auction although some sellers require theirs to be sold in the room. If your offer were accepted, the sale is under auction rules and you should be prepared to exchange contracts and pay the deposit on the day of the sale.

Jeremy Leaf is principal of Jeremy Leaf & Co, a north London firm of independent chartered surveyors, new homes development consultants, sales and lettings agents which began trading in 1984. Jeremy is also a fellow of the RICS as well as the National Association of Estate Agents (NAEA) and the Association of Residential Letting Agents (ARLA). He was residential chair of the Royal Institution of Chartered Surveyors (RICS) for over five years and its national housing spokesperson for 19.

6. Apply for a mortgage

Once you have made an offer and it has been accepted, if you need a mortgage you can make a full mortgage application through your mortgage broker or lender if you went to a bank or building society directly.

The mortgage lender needs a valuation survey and you need to appoint a legal professional to undertake the conveyancing process. You also need a survey (see below). Estate agents may recommend professionals for these parts of the process as might mortgage lenders, but you don’t have to follow these recommendations and should be told if the agent gets a referral fee.

7. Conveyancing

A solicitor, licensed conveyancer, chartered legal executive or CILEX practitioner can undertake the legal work that is necessary when buying a home. Your chosen legal professional will request proof of ID from you to comply with anti-money laundering rules.

"The average time for the conveyancing process in the UK ranges from around eight to 12 weeks but it varies greatly on the bespoke factors involved in each transaction," says Helen Hutchison, conveyancing partner at Irwin Mitchell. "The length of the conveyancing process depends on the individual circumstances such as the length of the chain of buyers, any issues from the surveys and information forms, any re-negotiations, and delays in mortgage approvals."

There are a number of things your appointed legal professional does.

Searches

If you are buying with a mortgage, your legal professional conducts a number of searches which show issues you need to be aware of. These aren’t required if you are buying with cash but are still recommended. Helen Hutchison explains that they include:

Local authority search to check for any planning issues, building control regulations, highways information, and environmental concerns.

Environmental search to flag up any risks such as flooding, subsidence, or contamination.

Water and drainage search to confirm the property is connected to the public water supply and sewer system. This will also confirm if the supply is metered.

Land Registry search to check the legal ownership of the property and any restrictions or covenants.

"There are also other searches which buyers may choose to have done, such as a chancel repair search which shows if the property is liable for the cost of repairs to the local parish church, a coal mining search and a more in-depth planning search," Helen explains.

"Although it’s rare, sometimes the searches could lead to a re-negotiation on price as they could affect the value of the property," she says. "Banks and other mortgage lenders will also need to see these searches to release the funds for the purchase."

Examining the contract and forms

Your conveyancer asks the seller’s conveyancer for a draft contract and the required paperwork from the seller, including the property information form and the fittings and contents form. If the property is leasehold, the seller also completes a leasehold information form.

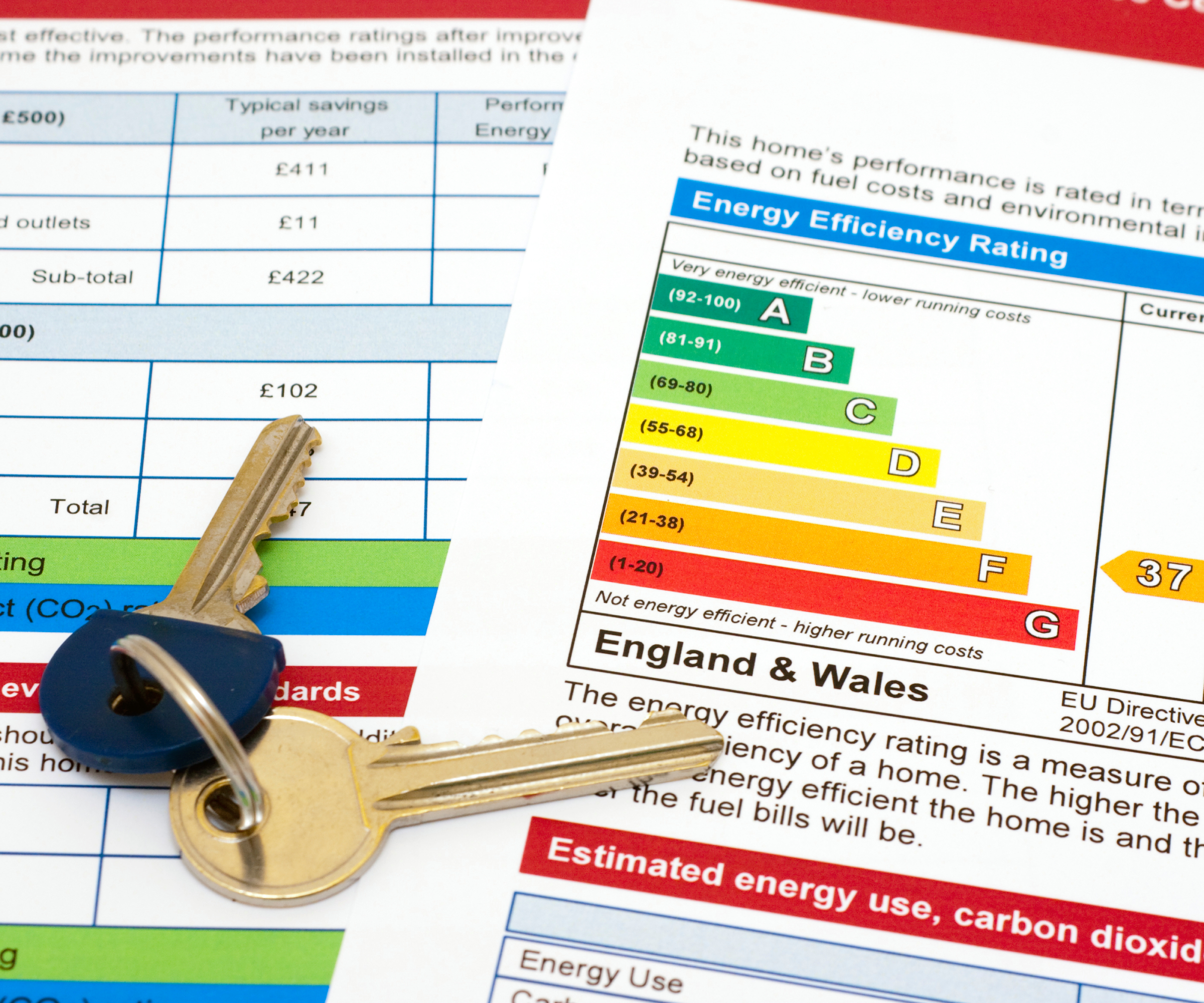

The property information form covers issues such as the boundaries of the property and disputes with neighbours. It also includes the energy performance certificate (EPC).

If the property has had work done that required planning permission or building regulations approval, copies of these should be included. Any solar panels are also detailed and whether they are owned or leased noted.

Guarantees and warranties should also be noted in the form. "FENSA certificates and the necessary gas and electrical installation certificates will confirm that any work was carried out to the correct standards," says Helen Hutchison.

The fixtures and fittings form shows which items are included in the sale, which excluded, and if there isn’t such an item.

"A good solicitor will then give you advice on any issues and implications from the information provided," says Helen.

Your conveyancer also examines the draft contract and raise any enquiries with the seller’s solicitor. You should also examine the forms, and raise your own questions as necessary with your conveyancer.

Be aware that if an issue arises which makes you change your mind about purchase you will still have incurred the costs of searches and the conveyancing work completed.

Legal work on any mortgage

If you’re buying with a mortgage, your conveyancer checks the mortgage offer and ensures that the lender’s requirements are satisfied. For cash buyers, the conveyancer checks the source of funds in accordance with the anti-money laundering requirements.

Paying stamp duty

The conveyancer’s role extends to paying stamp duty on your behalf after completion of the purchase.

Helen Hutchison is a partner in the residential property team at national law firm Irwin Mitchell. She deals with all aspects of conveyancing including sales, purchases, remortgages, shared ownership, relocations and equity release.

8. Survey and valuation

A mortgage lender requires a valuation of the property when you buy but you should also get your own survey of the property.

"A mortgage valuation is a market analysis looking at comparable transactions in the area to provide a market value of the property in question taking into account the general condition of the property," explains Francesca Watson of Otters Home Search who qualified as a member of the Royal Institution of Chartered Surveyors (RICS) in 2001. "A building survey looks at the condition, defects and repair options and does not comment on market value."

Choose a surveyor accredited by the Royal Institution of Chartered Surveyors (RICS) or the Residential Property Surveyors Association (RPSA). RICS offers three levels of survey: RICS level I, a condition report that notes any defects but generally doesn’t provide advice on managing them; level 2, providing more detail and information about future repairs and maintenance that may be needed; or level 3, which is the most comprehensive, analysing the property’s condition and giving advice on defects, repairs and maintenance.

RPSA offers a home buyer/condition survey, which reflects the condition of a traditional building of more modern or standard construction; or the more detailed building survey, which is suitable for larger, more complex, older, extended or higher value homes.

Whichever survey you choose, examine the details so you are aware of what is covered and what isn’t.

"Commissioning a building survey is absolutely crucial when purchasing a property," advises Francesca. "It will highlight areas which require attention (not all obvious to a layperson) and allow for a full assessment of the price being paid and re-negotiation as appropriate."

An alternative if there is a concern is to ask the seller if they will address it before completion. "It can be difficult to agree an accurate difference in value for repairing the issue, so it is sometimes smoother to have it rectified before completing the purchase," says Ashley Stevens, UK commercial director for insurance at Geobear. However, be mindful that the seller can say no, in which case you would have to decide if you wanted to pull out of the purchase.

The survey can also allow the conveyancer to check up on changes made to the home. "Your surveyor should be able to identify works undertaken to a property since its construction and your solicitor can then check that the relevant approvals and consents are in place," explains Lorna du Sautoy, partner at BDB Pitmans. "If there are any gaps in the seller’s paperwork then obtaining the relevant information about what was done and when may assist with obtaining legal indemnity insurance."

Note that if you are proposing to buy a home at auction you should get a survey beforehand. "Once the gavel goes down, you are committed to purchasing the property. Do your due diligence up front," says Francesca.

Francesca qualified as a member of the Royal Institution of Chartered Surveyors (RICS) in 2001 after graduating with a degree in estate surveying. She specialised in commercial and residential valuation at Montagu Evans and Donaldsons in London, before working in property finance. She has personally bought and renovated multiple properties. She co-founded Otters Home Search in 2023 with fellow property professional Abbie Long, drawing on her background to find the right homes for people in the Cotswolds.

Ashley Stevens is commercial director for insurance at Geobear. He has 22 years’ experience in insurance and ground engineering and holds membership of chartered institutions for surveying, loss adjusting, building, building engineering and party wall matters.

Lorna du Sautoy is a partner at the residential property team at the law firm BDB Pitmans. She acts for individuals buying, selling and renting property in the UK as well as investors, developers and funders.

9. Arrange home insurance

Be sure to arrange buildings insurance to start from exchange of contracts on your new home. If you are buying with a mortgage, this is a lender requirement.

You are responsible for the property from exchange, and if something happened to it the insurance is in place.

10. Exchange of contracts

Once you have received a mortgage offer (if you are buying with one), your conveyancer has received satisfactory responses to enquiries and corresponded with you about the purchase, buildings insurance is in place, and a completion date is agreed, and you have signed and returned the contract the conveyancer has sent you, exchange of contacts can go ahead. You need to transfer a deposit, normally 10 per cent of the purchase price, to your conveyancer’s client account before exchange.

At an agreed date and time the contracts are exchanged; your conveyancer does this on your behalf.

Once contracts are exchanged you are legally committed to the purchase. If you do not go ahead, you lose the deposit.

After exchange, your conveyancer lodges an interest in the property allowing them to process payment to the seller and apply to transfer the deeds into your name. They also apply to your lender for the mortgage funds, if applicable.

11. Completion and moving in

Completion takes place after exchange, typically one to four weeks later, as agreed, although this does vary. Only when the seller’s conveyancer confirms that funds are received does the estate agent hand you the keys.

After completion, the conveyancer pays stamp duty on your behalf. They also register your ownership at the Land Registry.

FAQs

Can you get a 100 per cent mortgage?

Some lenders offer 100 per cent mortgages so that you don’t have to pay anything at the start, but interest rates are higher than if you put down a deposit. One of these is likely to be a guarantor mortgage and a family member or friend would be responsible for the loan if you didn’t keep up with the payments. Don’t forget that even with a 100 per cent mortgage, housebuying brings additional costs you must budget for.

Preparation is essential to make housebuying as quick as possible. "The best way to ensure that your property acquisition goes through smoothly is to make sure that you have laid the foundations for a seamless transaction," says Lorna du Sautoy, partner at the residential property team at the law firm BDB Pitmans.

Get the Homebuilding & Renovating Newsletter

Bring your dream home to life with expert advice, how to guides and design inspiration. Sign up for our newsletter and get two free tickets to a Homebuilding & Renovating Show near you.

Sarah is a freelance journalist and editor writing for websites, national newspapers, and magazines. She’s spent most of her journalistic career specialising in homes.

She loves testing the latest home appliances and products, and investigating the benefits, costs and practicalities of home improvement. She is an experienced renovator and is currently remodelling the ground floor of her new home.

She was Executive Editor of Ideal Home and has worked for Your Home and Homes & Ideas. Her work has published by numerous titles, including The Guardian, channel4.com, Houzz, Grand Designs, Homes & Gardens, House Beautiful, Homes & Antiques, Real Homes, The English Home, Period Living, Beautiful Kitchens, Good Homes and Country Homes & Interiors.